- Topic

101k Popularity

16k Popularity

24k Popularity

257 Popularity

713 Popularity

- Pin

- 📢 Exclusive on Gate Square — #PROVE Creative Contest# is Now Live!

CandyDrop × Succinct (PROVE) — Trade to share 200,000 PROVE 👉 https://www.gate.com/announcements/article/46469

Futures Lucky Draw Challenge: Guaranteed 1 PROVE Airdrop per User 👉 https://www.gate.com/announcements/article/46491

🎁 Endless creativity · Rewards keep coming — Post to share 300 PROVE!

📅 Event PeriodAugust 12, 2025, 04:00 – August 17, 2025, 16:00 UTC

📌 How to Participate

1.Publish original content on Gate Square related to PROVE or the above activities (minimum 100 words; any format: analysis, tutorial, creativ - 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re - 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

June's real wages in Japan recover from the previous month but decrease by 1.3% compared to the same month last year. While there is a steady trend, the situation continues where prices are not being surpassed. | A clear explanation of important economic indicators of Japan and America | Moneyクリ Money's investment information and media useful for finances.

Announcement on August 6, 2025 (Wednesday) at 8:30

Japan Monthly Labor Statistics Survey June 2025 Preliminary Report

【1】Results: While the decline has narrowed, real wages have been negative for six consecutive months.

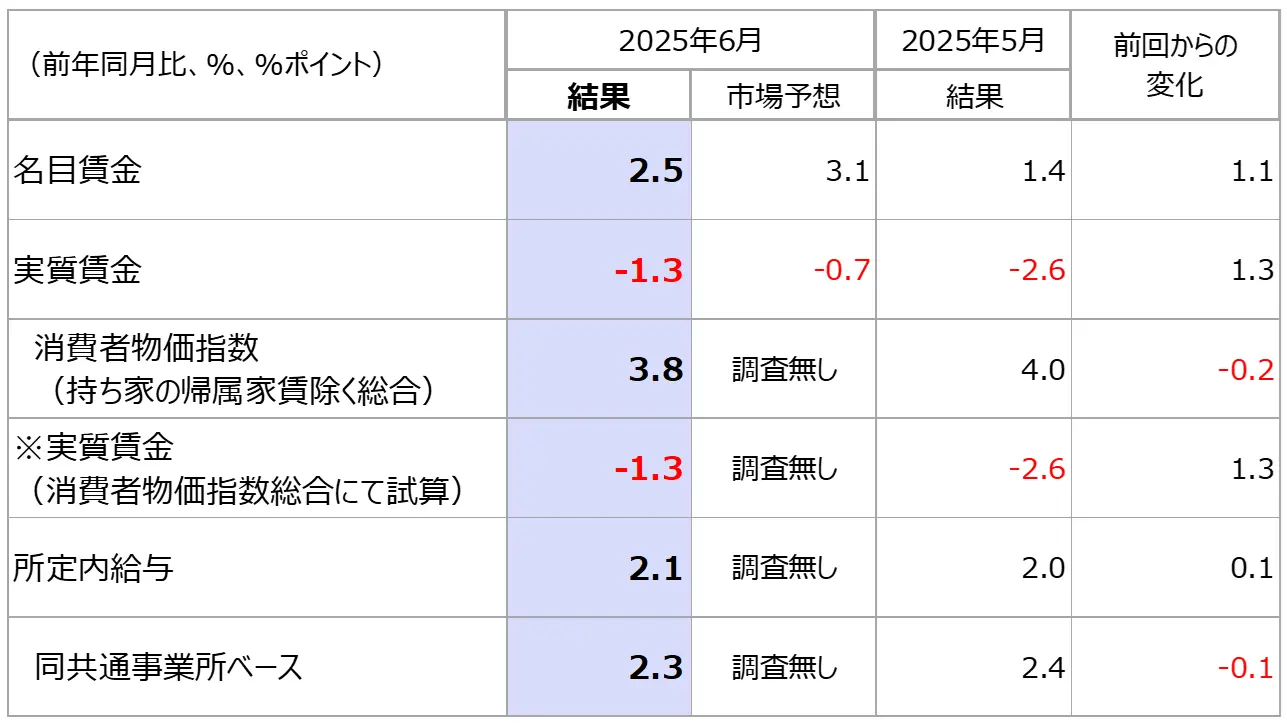

[Figure 1] Monthly Labor Statistics Survey June 2025 Preliminary Results Source: Created by Monex Securities based on data from the Ministry of Health, Labour and Welfare; the specified salary is for businesses with 5 or more employees, survey industry total.

In June 2025, nominal wages increased by 2.5% compared to the same month last year, rising from the previous May (revised figure). This fell short of market expectations, primarily due to a slowdown in special salary bonuses, which corresponded to a rise of 3.0%, down from 7.8% in June 2024. On the other hand, the regular wages, which make up the base salary, saw a slight acceleration, increasing by 2.1% from the previous month (revised figure). Even after excluding the impact of sample replacement, the common business site-based regular wages experienced a slowdown of 0.1 points but still showed solid results exceeding 2%.

Source: Created by Monex Securities based on data from the Ministry of Health, Labour and Welfare; the specified salary is for businesses with 5 or more employees, survey industry total.

In June 2025, nominal wages increased by 2.5% compared to the same month last year, rising from the previous May (revised figure). This fell short of market expectations, primarily due to a slowdown in special salary bonuses, which corresponded to a rise of 3.0%, down from 7.8% in June 2024. On the other hand, the regular wages, which make up the base salary, saw a slight acceleration, increasing by 2.1% from the previous month (revised figure). Even after excluding the impact of sample replacement, the common business site-based regular wages experienced a slowdown of 0.1 points but still showed solid results exceeding 2%.

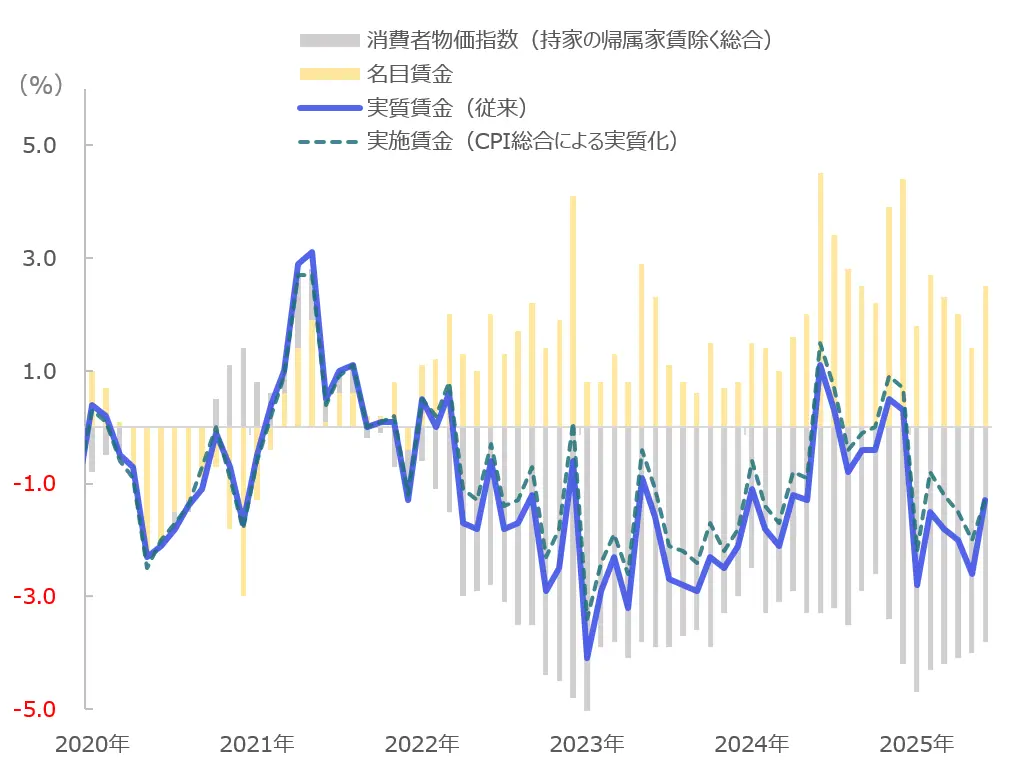

[Figure 2] Changes in Real Wages (Year-on-Year, %) Source: Created by Monex Securities from the Ministry of Health, Labour and Welfare, the Consumer Price Index (excluding imputed rent for owner-occupied housing) is displayed as negative.

In June, real wages decreased at a slower rate compared to the previous period, dropping by 1.3% year-on-year. On the other hand, there has been a negative trend for six consecutive months. The deflated real wages, based on the headline CPI (Consumer Price Index), also show a decrease of 1.3%. Although inflation has been gradually slowing down since the beginning of the year (see Chart 2, gray), it remains above 3%, continuing to outpace wage increases.

Source: Created by Monex Securities from the Ministry of Health, Labour and Welfare, the Consumer Price Index (excluding imputed rent for owner-occupied housing) is displayed as negative.

In June, real wages decreased at a slower rate compared to the previous period, dropping by 1.3% year-on-year. On the other hand, there has been a negative trend for six consecutive months. The deflated real wages, based on the headline CPI (Consumer Price Index), also show a decrease of 1.3%. Although inflation has been gradually slowing down since the beginning of the year (see Chart 2, gray), it remains above 3%, continuing to outpace wage increases.

【2】Content and Highlights: It is expected that real wages will gradually become positive in the future, but there is uncertainty surrounding the next bonuses.

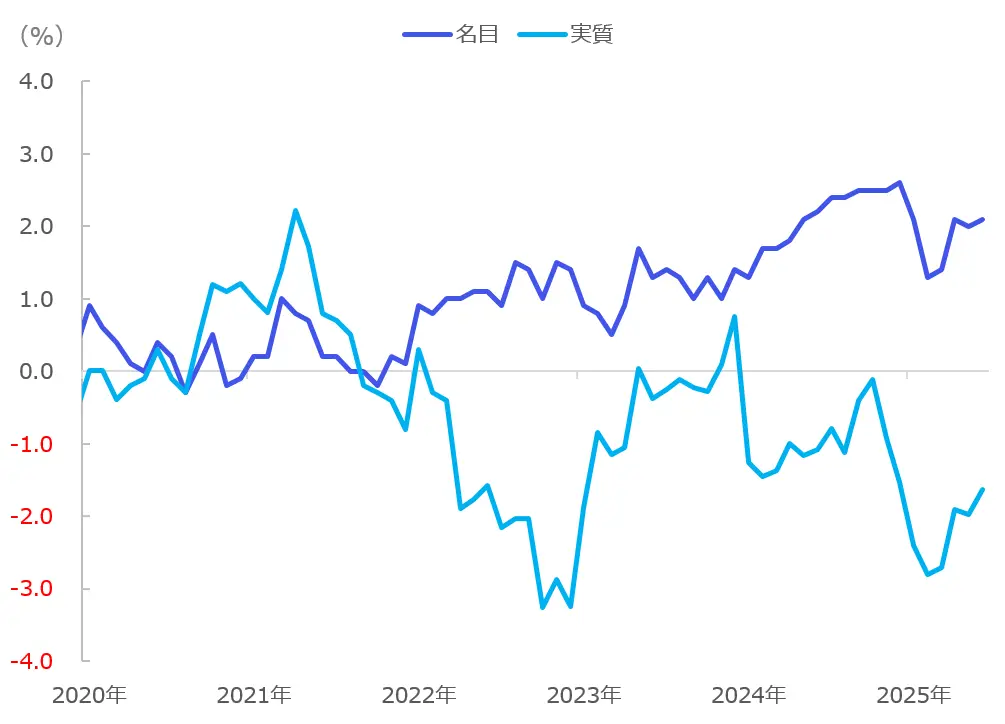

[Chart 3] Transition of prescribed salary (Year-on-year comparison, %) Source: Created by Monex Securities based on data from the Ministry of Health, Labour and Welfare. The real prescribed wages are calculated using the Consumer Price Index (excluding the imputed rent for owner-occupied housing).

The regular salary for June remained almost at the same level as the previous month, but showed a 2.1% increase compared to the same month last year. On a real basis, it continues to show a negative trend, and there is still a distance to turn into a real positive. The results of the spring labor negotiations are gradually being reflected, and a solid trend exceeding 2% is expected in the future. The key issue remains the trend in prices, and whether a slowdown will be observed in the second half of the year will be crucial.

Source: Created by Monex Securities based on data from the Ministry of Health, Labour and Welfare. The real prescribed wages are calculated using the Consumer Price Index (excluding the imputed rent for owner-occupied housing).

The regular salary for June remained almost at the same level as the previous month, but showed a 2.1% increase compared to the same month last year. On a real basis, it continues to show a negative trend, and there is still a distance to turn into a real positive. The results of the spring labor negotiations are gradually being reflected, and a solid trend exceeding 2% is expected in the future. The key issue remains the trend in prices, and whether a slowdown will be observed in the second half of the year will be crucial.

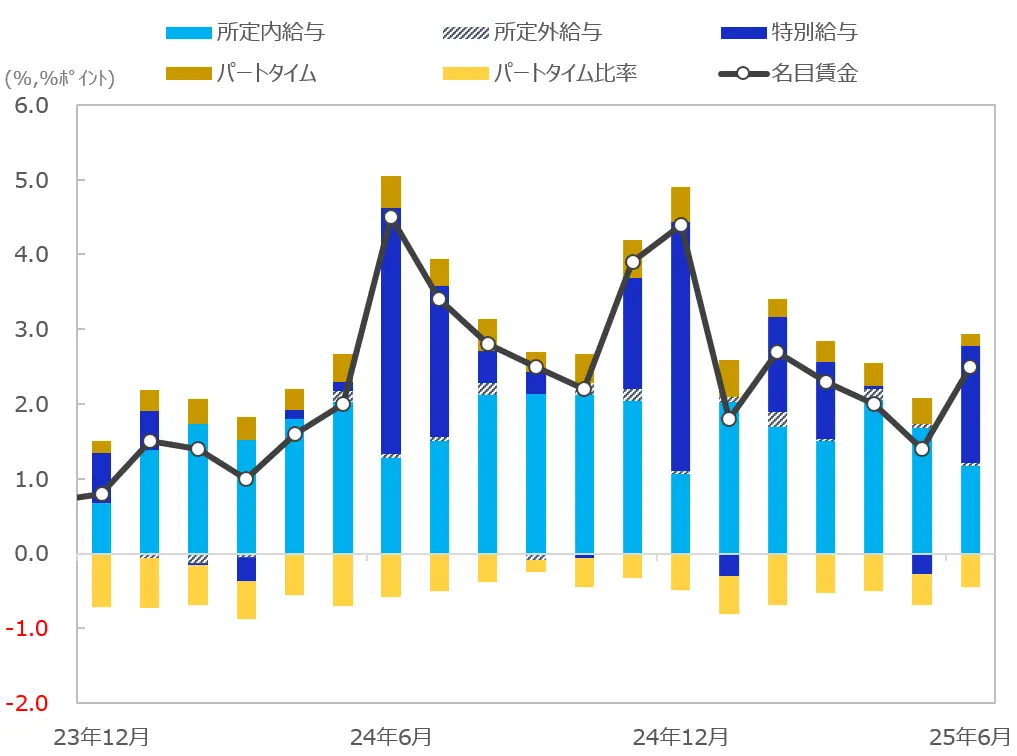

[Figure 4] Contribution Decomposition of Nominal Wages (Year-on-Year Comparison, %, Percentage Points) Source: Created by Monex Securities from the Ministry of Health, Labour and Welfare, regular salary, overtime salary, and special salary are figures for general workers.

The steady trend in wages is considered the main scenario for the future, but risk factors for the second half of the year include the potential reduction of winter bonuses and next year's wage increase funds due to a slowdown in corporate performance. The tariff policy by the United States is approaching a compromise point, but it is a fact that the tariff burden is increasing. Additionally, the global economic slowdown may lead to a deterioration in business sentiment in the manufacturing sector, which could result in a struggle for the next winter bonuses.

Source: Created by Monex Securities from the Ministry of Health, Labour and Welfare, regular salary, overtime salary, and special salary are figures for general workers.

The steady trend in wages is considered the main scenario for the future, but risk factors for the second half of the year include the potential reduction of winter bonuses and next year's wage increase funds due to a slowdown in corporate performance. The tariff policy by the United States is approaching a compromise point, but it is a fact that the tariff burden is increasing. Additionally, the global economic slowdown may lead to a deterioration in business sentiment in the manufacturing sector, which could result in a struggle for the next winter bonuses.

It can be pointed out that the last time was too high, but when looking at the actual comparison to last year, it has been confirmed that the contribution of the special salary in June this time has decreased, and it is considered that the next time is unlikely to exceed 2024 (Figure 4, blue).

【3】Impressions: The decision on interest rate hikes depends on domestic economic trends; if implemented, October may be the earliest.

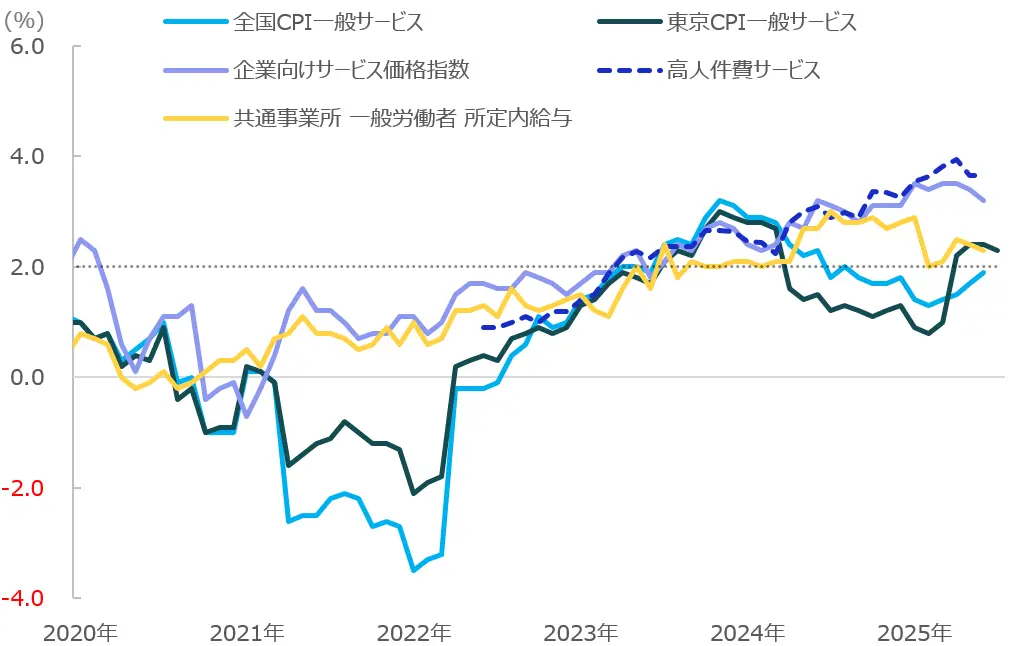

[Figure 5] Trends in service-related price indicators and wages (Year-on-Year, %) Source: Created by Monex Securities from the Ministry of Health, Labour and Welfare, Bank of Japan, and Ministry of Internal Affairs and Communications.

The continued rise in food prices is a major factor contributing to the high inflation in Japan, and there is also an impression that price trends related to services are remaining stable (Figure 5). Regarding underlying prices, the Bank of Japan seems to want to observe the situation a bit longer, but the minutes from the recent June monetary policy meeting of the Bank of Japan indicated a continued stance on interest rate hikes. Currently, what they are prioritizing is the domestic economic situation rather than prices. If the domestic economy remains stable despite the impacts of tariffs, an early interest rate hike can be expected; however, considering the lead time for data verification, it is speculated that the earliest timing could be in October.

Source: Created by Monex Securities from the Ministry of Health, Labour and Welfare, Bank of Japan, and Ministry of Internal Affairs and Communications.

The continued rise in food prices is a major factor contributing to the high inflation in Japan, and there is also an impression that price trends related to services are remaining stable (Figure 5). Regarding underlying prices, the Bank of Japan seems to want to observe the situation a bit longer, but the minutes from the recent June monetary policy meeting of the Bank of Japan indicated a continued stance on interest rate hikes. Currently, what they are prioritizing is the domestic economic situation rather than prices. If the domestic economy remains stable despite the impacts of tariffs, an early interest rate hike can be expected; however, considering the lead time for data verification, it is speculated that the earliest timing could be in October.

Monex Securities Financial Intelligence Department Keita Yamaguchi